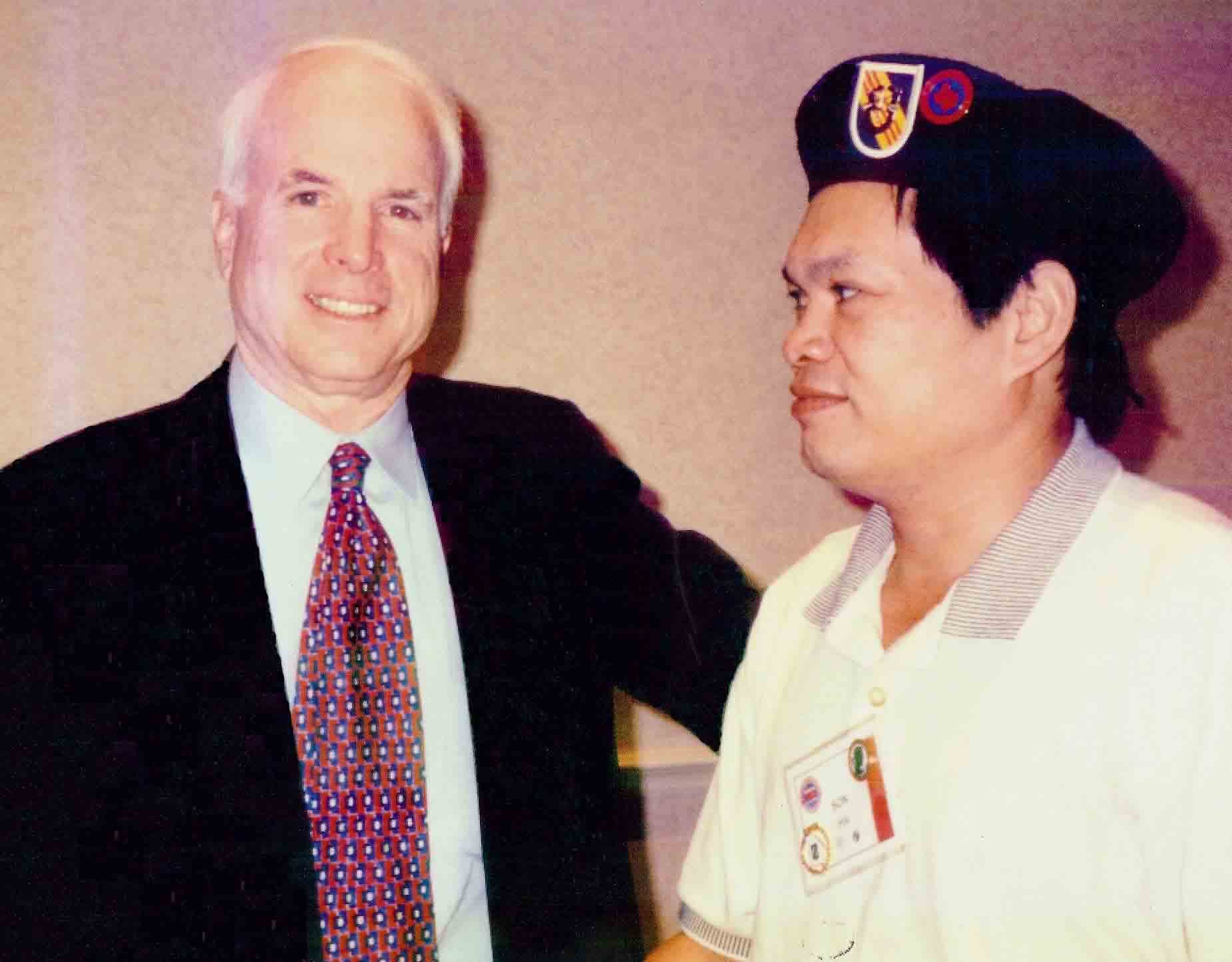

at Capitol. June 19.1996

with Sen. JohnMc Cain

with General John K Singlaub

CNBC .Fox .FoxAtl .. CFR. CBS .CNN .VTV.

.WhiteHouse .NationalArchives .FedReBank

.Fed Register .Congr Record .History .CBO

.US Gov .CongRecord .C-SPAN .CFR .RedState

.VideosLibrary .NationalPriProject .Verge .Fee

.JudicialWatch .FRUS .WorldTribune .Slate

.Conspiracy .GloPolicy .Energy .CDP .Archive

.AkdartvInvestors .DeepState .ScieceDirect

.NatReview .Hill .Dailly .StateNation .WND

-RealClearPolitics .Zegnet .LawNews .NYPost

.SourceIntel .Intelnews .QZ .NewAme

.GloSec .GloIntel .GloResearch .GloPolitics

.Infowar .TownHall .Commieblaster .EXAMINER

.MediaBFCheck .FactReport .PolitiFact .IDEAL

.MediaCheck .Fact .Snopes .MediaMatters

.Diplomat .NEWSLINK .Newsweek .Salon

.OpenSecret .Sunlight .Pol Critique .

.N.W.Order .Illuminatti News.GlobalElite

.NewMax .CNS .DailyStorm .F.Policy .Whale

.Observe .Ame Progress .Fai .City .BusInsider

.Guardian .Political Insider .Law .Media .Above

.SourWatch .Wikileaks .Federalist .Ramussen

.Online Books .BREIBART.INTERCEIPT.PRWatch

.AmFreePress .Politico .Atlantic .PBS .WSWS

.NPRadio .ForeignTrade .Brookings .WTimes

.FAS .Millenium .Investors .ZeroHedge .DailySign

.Propublica .Inter Investigate .Intelligent Media

.Russia News .Tass Defense .Russia Militaty

.Scien&Tech .ACLU .Veteran .Gateway. DeepState

.Open Culture .Syndicate .Capital .Commodity

.DeepStateJournal .Create .Research .XinHua

.Nghiên Cứu QT .NCBiển Đông .Triết Chính Trị

.TVQG1 .TVQG .TVPG .BKVN .TVHoa Sen

.Ca Dao .HVCông Dân .HVNG .DấuHiệuThờiĐại

.BảoTàngLS.NghiênCứuLS .Nhân Quyền.Sài Gòn Báo

.Thời Đại.Văn Hiến .Sách Hiếm.Hợp Lưu

.Sức Khỏe .Vatican .Catholic .TS KhoaHọc

.KH.TV .Đại Kỷ Nguyên .Tinh Hoa .Danh Ngôn

.Viễn Đông .Người Việt.Việt Báo.Quán Văn

.TCCS .Việt Thức .Việt List .Việt Mỹ .Xây Dựng

.Phi Dũng .Hoa Vô Ưu.ChúngTa .Eurasia.

CaliToday .NVR .Phê Bình . TriThucVN

.Việt Luận .Nam Úc .Người Dân .Buddhism

.Tiền Phong .Xã Luận .VTV .HTV .Trí Thức

.Dân Trí .Tuổi Trẻ .Express .Tấm Gương

.Lao Động .Thanh Niên .Tiền Phong .MTG

.Echo .Sài Gòn .Luật Khoa .Văn Nghệ .SOTT

.ĐCS .Bắc Bộ Phủ .Ng.TDũng .Ba Sàm .CafeVN

.Văn Học .Điện Ảnh .VTC .Cục Lưu Trữ .SoHa

.ST/HTV .Thống Kê .Điều Ngự .VNM .Bình Dân

.Đà Lạt * Vấn Đề * Kẻ Sĩ * Lịch Sử *.Trái Chiều

.Tác Phẩm * Khào Cứu * Dịch Thuật * Tự Điển *

KIM ÂU -CHÍNHNGHĨA -TINH HOA - STKIM ÂU

CHÍNHNGHĨA MEDIA-VIETNAMESE COMMANDOS

BIÊTKÍCH -STATENATION - LƯUTRỮ -VIDEO/TV

DICTIONAIRIES -TÁCGỈA-TÁCPHẨM - BÁOCHÍ . WORLD - KHẢOCỨU - DỊCHTHUẬT -TỰĐIỂN -THAM KHẢO - VĂNHỌC - MỤCLỤC-POPULATION - WBANK - BNG ARCHIVES - POPMEC- POPSCIENCE - CONSTITUTION

VẤN ĐỀ - LÀMSAO - USFACT- POP - FDA EXPRESS. LAWFARE .WATCHDOG- THỜI THẾ - EIR.

ĐẶC BIỆT

-

The Invisible Government Dan Moot

-

The Invisible Government David Wise

ADVERTISEMENT

Le Monde -France24. Liberation- Center for Strategic- Sputnik

https://www.intelligencesquaredus.org/

Space - NASA - Space News - Nasa Flight - Children Defense

Pokemon.Game Info. Bách Việt Lĩnh Nam.US Histor. Insider

World History - Global Times - Conspiracy - Banking - Sciences

World Timeline - EpochViet - Asian Report - State Government

https://lens.monash.edu/@politics-society/2022/08/19/1384992/much-azov-about-nothing-how-the-ukrainian-neo-nazis-canard-fooled-the-world

with General Micheal Ryan

DEBT CLOCK . WORLMETERS . TRÍ TUỆ MỸ . SCHOLARSCIRCLE. CENSUS - SCIENTIFIC - COVERT- CBO - EPOCH ĐKN - REALVOICE -JUSTNEWS- NEWSMAX - BREIBART - REDSTATE - PJMEDIA - EPV - REUTERS - AP - NTD - REPUBLIC TTV - BBC - VOA - RFI - RFA - HOUSE - TỬ VI - VTV- HTV - PLUS - TTRE - VTX - SOHA -TN - CHINA - SINHUA - FOXNATION - FOXNEWS - NBC - ESPN - SPORT - ABC- LEARNING - IMEDIA -NEWSLINK - WHITEHOUSE- CONGRESS -FED REGISTER -OAN DIỄN ĐÀN - UPI - IRAN - DUTCH - FRANCE 24 - MOSCOW - INDIA - NEWSNOW- KOTAHON - NEWSPUNCH - CDC - WHO BLOOMBERG - WORLDTRIBUNE - WND - MSNBC- REALCLEAR - PBS - SCIENCE - HUMAN EVENT - TABLET - AMAC - WSWS PROPUBICA -INVESTOPI-CONVERSATION - BALANCE - QUORA - FIREPOWER GLOBAL- NDTV- ALJAZEER- TASS- DAWN NATURAL- PEOPLE- BRIGHTEON - CITY JOURNAL- EUGENIC- 21CENTURY - PULLMAN- SPUTNIK- COMPACT - DNYUZ- CNA

NIK- JAP- SCMP- CND- JAN- JTO-VOE- ASIA- BRIEF- ECNS-TUFTS- DIPLOMAT- JUSTSECU- SPENDING- FAS - GWINNETT JAKARTA -- KYO- CHIA - HARVARD - INDIATO - LOTUS- CONSORTIUM - COUNTERPUNCH- POYNTER- BULLETIN - CHI DAILY

24

FEDERAL

RESERVE

Paul

Winfree

M

Money

is

the

essential unit

of

measure

for

the

voluntary exchanges

that constitute

the

market economy.

Stable money

allows people

to

work

freely,

helps businesses

grow, facilitates

investment, supports

saving

for

retirement, and

ultimately provides

for

economic

growth. The

federal govern-

ment

has

long made

policy regarding

the

nation’s

money on

behalf of

the

people

through

their elected

representatives

in

Congress.1 Over

time,

however, Congress has

delegated that

responsibility

first

to

the

Department of

the

Treasury

and

now

to the quasi-public Federal

Reserve System.

The

Federal

Reserve was

created by

Congress in

1913 when

most Americans

lived

in

rural

areas

and

the

largest industry

was

agriculture.

The

impetus

was

a

series of

financial

crises caused

both by

irresponsible

banks

and

other

financial institutions

that

overextended

credit

and

by

poor

regulations. The

architects of

the

Federal

Reserve

believed

that

a

quasi-public clearinghouse

acting as

lender of

last resort

would reduce

financial

instability

and

end

severe recessions.

However, the

Great Depression

of

the

1930s

was

needlessly prolonged

in

part

because of

the

Federal

Reserve’s inept

manage-

ment

of

the

money supply.

More recessions

followed in

the

post–World

War

II

years. In

the decades

since the

Federal Reserve

was created,

there has

been a

down- turn

roughly

every

five

years.

This

monetary

dysfunction

is

related

in

part

to

the impossibility

of

fine-tuning the

money

supply

in

real

time,

as

well

as

to

the

moral hazard

inherent in

a political system

that has

demonstrated a history

of bailing

out

private

firms when

they engage

in

excess

speculation.

Public control of money creation

through the Federal Reserve System has

another

major

problem:

Government

can

abuse

this

authority

for

its

own

advantage

Mandate for

Leadership: The Conservative

Promise

by

printing money

to

finance

its

operations.

This necessitated

the

original

Federal Reserve’s decentralization and political

independence. Not long after the central

bank’s creation,

however, monetary

decision-making

power

was

transferred

away from

regional member

banks and

consolidated in

the Board

of Governors.

The

Federal

Reserve’s independence

is

presumably

supported by

its

mandate

to

maintain

stable prices.

Yet

central

bank independence

is

challenged

in

two

addi- tional ways.

First, like

any

other

public institution,

the

Federal

Reserve responds

to the potential

for

political

oversight when

faced with

challenges.2 Consequently,

its

independence in

conducting monetary

policy is

more assured

when the

economy is

experiencing

sustained growth

and

when

there is

low

unemployment

and

price

stabil-

ity—but

less

so

in

a

crisis.3 Additionally,

political pressure

has

led

the

Federal

Reserve to use

its

power

to

regulate

banks as

a

way

to

promote

politically favorable

initiatives

including

those

aligned

with environmental,

social, and

governance (ESG)

objectives.4 Even

formal

grants

of

power

by

Congress

have not

markedly improved

Federal Reserve

actions.

Congress gave

the

Federal

Reserve greater

regulatory authority over

banks after

the

stock

market crash

of

1929.

During the

Great Depression,

the Federal Reserve

was

given

the

power

to

set

reserve requirements

on

banks

and

to

regulate

loans for

the purchase

of securities.

During the

stagflation of

the 1970s,

Congress

expanded

the

Federal

Reserve’s

mandate

to

include

“maximum

employ- ment,

stable prices,

and moderate

long-term

interest rates.”5 In the wake

of the

2008

global financial

crisis,

the

Federal

Reserve’s

banking

and

financial

regulatory authorities

were

broadened

even further. The

Great

Recession

also

led to

innova-

tions

by

the

central bank

such as

additional large-scale

asset purchases.

Together,

these expansions

have created

significant risks

associated with

“too big

to

fail”

financial institutions

and

have

facilitated government

debt creation.6 Collec- tively,

such developments

have eroded

the

Federal

Reserve’s economic

neutrality.

In

essence, because

of

its

vastly expanded

discretionary

powers

with respect to

monetary and

regulatory policy,

the

Fed

lacks both

operational effectiveness

and

political

independence.

To

protect the

Federal Reserve’s

independence and to

improve monetary

policy outcomes,

Congress should

limit its

mandate to

the sole objective of

stable money.

This chapter

provides a number of options aimed at achieving these goals

along

with

the

costs and

benefits of

each policy

recommendation.

These

recommended

reforms

are divided

into

two

parts:

broad institutional

changes

and

changes

involv- ing the

Federal

Reserve’s management

of the

money supply.

BROAD

RECOMMENDATIONS

•

Eliminate the “dual mandate.”

The Federal Reserve was originally

created to

“furnish an

elastic

currency” and rediscount

commercial paper so

that

the

supply

of

credit

could

increase

along

with

the

demand

for

money

2025 Presidential

Transition Project

and

bank credit.

In

the

1970s, the

Federal Reserve’s

mission was

amended to

maintain

macroeconomic

stability following the abandonment

of the

gold

standard.7 This

included

making the

Federal Reserve

responsible for maintaining

full employment,

stable prices,

and

long-term

interest rates.

Supporters

of

this

more expansive

mandate claim

that monetary

policy

is

needed

to

help

the

economy avoid

or

escape

recessions. Hence,

even if

there

is a

built-in bias

toward

inflation, that bias

is worth

it to

avoid the

pain

of

economic

stagnation. This

accommodationist

view

is

wrong.

In

fact,

that

same easy

money causes

the clustering of failures

that can

lead to

a recession.

In

other

words,

the

dual

mandate

may

inadvertently

contribute to

recessions rather than fixing them.

A

far less

harmful

alternative is to

focus the

Federal Reserve

on protecting

the dollar and

restraining inflation. This

can mitigate

economic

turmoil, perhaps in

conjunction with government

spending.

Fiscal policy

can be

more

effective

if

it

is

timely,

targeted,

and

temporary.8 An

example

from the COVID-19

pandemic is

the

Paycheck

Protection Program,

which sustained

businesses

far

more

effectively than

near-zero interest

rates, which

mainly aided

asset markets

and housing

prices. It

is also

worth noting

that the

problem

of

the

dual

mandate

may

worsen

with

new

pressure

on

the

Federal Reserve

to include

environmental

or redistributionist “equity” goals

in its

policymaking, which

will

likely

enable

additional

federal

spending.9

•

Limit the Federal Reserve’s lender-of-last-resort function.

To protect

banks that

over lend

during easy

money episodes,

the Federal

Reserve

was

assigned a

“lender of

last resort”

(LOLR)

function. This

amounts to

a standing

bailout

offer

and

encourages

banks

and

nonbank

financial

institutions

to

engage

in

reckless

lending

or

even

speculation

that

both

exacerbates

the

boom-and-bust

cycle and

can

lead

to

financial

crises such

as those of 199210 and 200811 with ensuing bailouts.

This

function

should be

limited so

that banks

and other

financial institutions

behave more

prudently,

returning to their

traditional role as

conservative lenders

rather

than

taking

risks

that

are

too

large

and

lead

to

still

another

taxpayer

bailout.

Such

a

reform

should

be

given

plenty

of

lead time

so that

banks can

self-correct lending practices

without

disrupting a financial

system that

has grown

accustomed to such

activities.

•

Wind down the Federal Reserve’s balance sheet.

Until the 2008 crisis,

the

Federal

Reserve

never

held

more

than

$1

trillion

in

assets,

bought

largely

Mandate for

Leadership: The Conservative

Promise

to

influence monetary

policy.12 Since

then,

these assets

have exploded,

and the

Federal

Reserve now

owns nearly

$9 trillion

of mainly

federal debt

($5.5 trillion)13

and mortgage-backed securities ($2.6

trillion).14 There is currently

no government

oversight of the

types of

assets that

the Federal

Reserve purchases.

These

purchases have

two main

effects: They

encourage

federal deficits

and

support

politically

favored

markets,

which

include

housing

and

even

corporate

debt. Over

half

of

COVID-era

deficits

were

monetized

in

this

way by

the Federal

Reserve’s

purchase of

Treasuries, and housing

costs were

driven to historic highs

by the

Federal

Reserve’s purchase

of mortgage

securities. Together,

this policy

subsidizes government debt,

starving business

borrowing,

while

rewarding

those

who

buy

homes

and

certain

corporations at

the expense

of the

wider public.

Federal

Reserve

balance sheet

purchases

should be

limited by

Congress, and

the Federal

Reserve’s

existing

balance

sheet

should

be

wound

down

as quickly

as

is

prudent

to

levels

similar

to

what

existed

historically before

the 2008 global

financial crisis.15

•

Limit future balance sheet expansions to U.S. Treasuries.

The Federal

Reserve

should be

prohibited from picking

winners and

losers among

asset

classes. Above

all, this

means limiting

Federal Reserve

interventions in

the

mortgage-backed

securities market. It

also means

eliminating Fed interventions in

corporate and municipal

debt markets.

Restricting

the Fed’s

open market

operations to Treasuries

has strong

economic support.

The goal

of monetary

policy is

to provide markets

with

needed

liquidity

without inducing

resource

misallocations

caused by

interfering

with

relative

prices, including

rates

of

return

to

securities. However,

Fed

intervention in

longer-term

government

debt,

mortgage-

backed securities,

and corporate

and municipal

debt can

distort the

pricing process.

This more

closely

resembles credit

allocation than liquidity

provision.

The

Fed’s

mortgage-related

activities are

a

paradigmatic

case of

what monetary

policy

should

not

do.

Consider the

effects of

monetary policy

on

the

housing market.

Between February

2020 and

August 2022,

home prices

increased

42 percent.16

Residential

property

prices in

the United States

adjusted

for inflation

are

now

5.8

percent

above

the

prior

all-time

record levels

of 2006.17 The home-price-to-median-income

ratio is

now 7.68,

far

2025 Presidential

Transition Project

above

the

prior

record high

of

7.0

set

in

2005.18 The

mortgage-payment-to-

income

ratio hit

43.3 percent

in

August

2022—breaking

the

highs of

the

prior

housing

bubble in

2008.19

Mortgage

payment

on

a

median-priced

home

(with a

20 percent

down payment)

jumped to

$2,408 in

the autumn

of 2022

vs.

$1,404

just

one

year

earlier as

home prices

continued to

rise even

as

mortgage

rates

more

than doubled.

Renters have

not

been

spared: Median

apartment rental

costs have

jumped more

than 24

percent since

the start

of 2021.20 Numerous

cities experienced

rent increases

well in

excess of

30

percent.

A

primary driver

of higher

costs during

the past

three years

has been

the Federal Reserve’s purchases

of

mortgage-backed

securities (MBS). Since March

2020, the

Federal

Reserve has

driven down

mortgage

interest rates and

fueled a

rise in

housing costs

by purchasing

$1.3 trillion

of MBSs

from Fannie

Mae,

Freddie

Mac,

and

Ginnie

Mae.

The

$2.7

trillion

now

owned

by the

Federal

Reserve is

nearly double

the levels

of March

2020. The

flood of

capital

from

the

Federal

Reserve

into

MBSs

increased

the

amount

of

capital

available for

real estate

purchases while

lower interest

rates on

mortgage

borrowing—driven

down

in

part

by

the

Federal

Reserve’s

MBS

purchases—

induced and

enabled

borrowers to

take on

even larger

loans.21

The

Federal Reserve

should be

precluded

from

any

future

purchases

of

MBSs

and

should wind

down

its

holdings

either by

selling

off

the

assets

or

by

allowing

them

to mature

without replacement.

•

Stop paying interest on excess reserves.

Under this policy, also

started during

the 2008

financial crisis, the

Federal

Reserve effectively

prints money and then

“borrows” it

back from banks

rather than

those banks’

lending money to the

public. This

amounts to

a transfer

to Wall

Street at the

expense of

the American

public and

has driven

such excess

reserves to $3.1 trillion,

up seventyfold

since 2007.22

The

Federal

Reserve should

immediately

end

this

practice and

either sell

off

its

balance sheet

or

simply

stop

paying

interest so

that banks

instead lend

the

money.

Congress should

bring

back

the

pre-2008

system, founded

on

open-market

operations. This

minimizes

the Fed’s

power to

engage in

preferential

credit allocation.

MONETARY

RULE REFORM

OPTIONS

While

the

above

recommendations

would

reduce Federal

Reserve manipulation

and

subsidies,

none would

limit the

inflationary and

recessionary cycles

caused by

the

Federal

Reserve. For

that, major

reform of

the

Federal

Reserve’s core

activity of

manipulating interest rates

and money

would be

needed.

A core problem

with

government control

of monetary

policy is

its exposure to two

unavoidable political pressures:

pressure to

print money to

subsidize

Mandate for

Leadership: The Conservative

Promise

government

deficits and

pressure to

print money

to

boost

the

economy

artificially

until the

next election.

Because both

will always

exist with

self-interested

politi- cians,

the only

permanent

remedy is

to take the

monetary

steering wheel

out of the

Federal Reserve’s hands

and return

it to

the people.

This could be

done by abolishing the federal role in money altogether,

allowing

the use of

commodity money, or embracing a strict monetary-policy rule to

ward off

political

meddling. Of

course, neither

free banking

nor

a

allowing commodi-

ty-backed

money

is

currently being

discussed, so

we

have

formulated a

menu of reforms.

Each option

involves trade-offs

between how

effectively it

restrains the

Federal

Reserve and

how

difficult

each policy

would be

to

implement,

both polit-

ically

for Congress

and

economically in

terms of

disruption to

existing

financial institutions. We present these options in decreasing order of

effectiveness against inflation and boom-and-bust

recessionary cycles.

Free Banking.

In

free

banking, neither

interest rates

nor

the

supply of

money

is controlled by the government. The Federal Reserve is effectively

abolished, and

the

Department of

the

Treasury

largely limits

itself to

handling the

government’s

money. Regions

of

the

U.S. actually

had

a

similar system,

known as

the

“Suffolk

System,”

from 1824

until the

1850s, and

it

minimized

both inflation

and

economic

disruption

while allowing

lending to

flourish.23

Under free banking, banks typically

issue liabilities (for example, checking accounts)

denominated in dollars

and backed

by a

valuable

commodity. In

the 19th

century,

this

backing

was

commonly

gold

coins:

Each

dollar,

for

example,

was defined

as about

1/20 of

an ounce

of gold,

redeemable on demand

at the

issuing bank.

Today,

we

might

expect

most

banks

to

back

with

gold,

although

some

might

prefer

to

back

their

notes

with

another

currency

or

even

by

equities

or

other

assets such

as

real

estate.

Competition

would

determine

the

right

mix

of

assets

in

banks’

portfolios as backing for their liabilities.

As

in

the

Suffolk System,

competition keeps

banks from

overprinting or

lending irresponsibly.

This is

because any

bank that

issues more

paper than

it has

assets available would

be

subject

to

competitor

banks’

presenting

its

notes

for

redemp- tion.

In the

extreme, an

overissuing

bank could

be liable

to a

bank run.

Reckless banks’

competitors

have

good

incentives

to

police

risk

closely

lest

their

own

hold- ings of

competitor dollars become worthless.24

In this way,

free banking leads to stable and sound currencies and strong

finan- cial

systems

because customers

will avoid

the riskier

issuers,

driving them

out of the

market. As

a result

of this

stability and

lack of

inflation

inherent in

fully backed

currencies, free

banking

could

dramatically

strengthen

and

increase

both the

dominant role

of America’s financial

industry and

the use of

the U.S.

dollar as the

global

currency of

choice.25 In fact, under

free banking,

the norm

is for

the dollar’s purchasing power

to rise

gently over

time,

reflecting gains in

economic productivity.

This

“supply-side deflation”

does

not

cause

economic

busts.

In

fact,

2025 Presidential

Transition Project

by

ensuring

that cash

earns a

positive

(inflation-adjusted)

rate of

return, it

can

pre-

vent

households and

businesses from

holding inefficiently

small money

balances.

Further

benefits

of

free

banking include

dramatic reduction

of

economic

cycles,

an end to

indirect

financing of

federal

spending, removal

of the

“lender of

last resort”

permanent

bailout

function

of

central

banks,

and

promotion

of

currency

competition.26

This

allows

Americans many

more ways

to protect

their savings.

Because free

banking

implies that

financial services and

banking would

be gov-

erned

by

general

business

laws

against,

for

example,

fraud

or

misrepresentation,

crony

regulatory

burdens

that hurt

customers

would

be

dramatically

eased,

and innovation

would be encouraged.

Potential

downsides of

free banking

stem from

its

greatest

benefit: It

has

mas-

sive political hurdles to

clear. Economic theory predicts and economic history

confirms that free banking is

both stable and productive, but it is radically different

from

the

system

we

have

now.

Transitioning to

free

banking

would

require

polit-

ical

authorities, including

Congress

and

the

President,

to

coordinate

on

multiple

reforms simultaneously.

Getting any of them wrong could imbalance an otherwise

functional

system.

Ironically,

it

is

the

very

strength

of

a

true

free

banking

system that

makes transitioning to one so difficult.

Commodity-Backed Money.

For

most

of

U.S.

history, the

dollar was

defined in terms

of

both

gold and

silver. The

problem was

that when

the

legal

price differed

from

the

market

price,

the artificially

undervalued

currency would

disappear

from

circulation. There were

times, for instance, when this mechanism put the U.S. on

a

de

facto

silver

standard.

However,

as

a

result,

inflation

was

limited.

Given

this track

record, restoring

a

gold

standard retains

some appeal

among

monetary

reformers who

do

not

wish

to go

so

far

as

abolishing

the

Federal

Reserve. Both the 2012

and 2016 GOP platforms urged the establishment of a commis- sion to consider

the feasibility

of a

return to

the gold

standard,27

and

in October

2022,

Representative

Alexander

Mooney

(R–WV)

introduced

a

bill

to

restore

the gold

standard.28

In economic

effect, commodity-backing the dollar differs from free banking

in that

the government (via the Fed) maintains both regulatory and

bailout functions. However,

manipulation of

money and

credit is

limited because

new

dollars

are

not

costless

to

the

federal government:

They must

be

backed

by

some

hard asset

like gold. Compared

to

free

banking, then,

the

benefits

of

commodity-backed

money are

reduced, but

transition

disruptions are also

smaller.

The process of

commodity backing is

very

straightforward:

Treasury could set

the price

of a dollar at

today’s market

price of

$2,000 per

ounce of

gold. This

means

that

each

Federal

Reserve

note

could

be

redeemed

at

the

Federal

Reserve

and exchanged

for

1/2000

ounce

of

gold—about

$80,

for

example,

for

a

gold

coin

the

weight

of

a

dime.

Private

bank liabilities

would

be

redeemable

upon

their

issuers. Banks

could

send

those

traded-in

dollars to

the

Treasury

for

gold

to

replenish

their

Mandate for

Leadership: The Conservative

Promise

vaults.

This creates

a powerful

self-policing mechanism: If

the federal

govern- ment

creates

dollars

too

quickly,

more

people

will

doubt

the

peg

and

turn

in

their gold

to

banks,

which

then

will

turn

in

their

gold

and

drain

the

government’s gold.

This

forces

governments to

rein

in

spending

and

inflation

lest

their

gold

reserves become

depleted.

One

concern raised

against commodity

backing is

that there

is

not

enough gold in the

federal government for all the dollars in existence. This is

solved by making

sure

that

the

initial

peg

on

gold is

correct. Also,

in

reality,

a

very

small number

of

users

trade for

gold as

long as

they believe

the

government

will stick

to

the

price peg. The

mere fact

that people

could

exchange

dollars

for

gold

is

what

acts as

the

enforcer.

After

all,

if

one

is

confident

that a

dollar will

still be

worth 1/2000

ounce of gold

in

a

year, it

is

much

easier to

walk about

with paper

dollars and

use

credit

cards

than it

is

to

mail tiny

$80

coins.

People would

redeem en

masse only

if

they

feared

the

government

would not

be

able

control itself,

for

which

the

only

solution is for the

government to control itself.

Beyond

full backing,

alternate paths

to

gold

backing might

involve gold-con-

vertible

Treasury

instruments29

or

allowing a

parallel gold

standard to

operate temporarily

alongside the

current fiat

dollar.30 These could ease

adoption while

minimizing disruption, but

they should be temporary so that we can quickly enjoy

the

benefits

of gold’s

ability

to

police

government

spending.

In

addition,

Congress could

simply allow

individuals to

use

commodity-backed

money without

fully replacing the current system.

Among

downsides to

a

commodity

standard, there

is

no

guarantee that

the

gov-

ernment

will

stick

to

the

price

peg.

Also, allowing

a

commodity

standard

to operate

along

with

a

fiat

dollar

opens

both

up

for

a

speculative attack.

Another

downside

is

that

even

under

a

commodity

standard,

the

Federal

Reserve

can

still

influence

the

economy

via interest

rate

or

other

interventions.

Therefore,

at

best,

a

commodity

standard

is

not

a

full

solution

to

returning

to

free

banking.

We

have

good

reasons

to worry

that

central

banks

and

the

gold

standard

are

fundamentally

incompati- ble—as

the

disastrous

experience

of

the

Western

nations

on

their

“managed

gold standards”

between

World War

I

and

World

War

II

showed.

K-Percent Rule.

Under

this rule,

proposed by

Milton

Friedman in

1960,31 the Federal

Reserve would

create money

at a

fixed rate—say

3 percent

per year.

By offering

the

inflation

benefits

of

gold

without

the

potential

disruption

to

the

finan- cial

system,

a

K-Percent

Rule could

be

a

more

politically

viable

alternative

to

gold.

The principal flaw

is that

unlike

commodities, a

K-Percent Rule

is not

fixed by physical costs: It could change according to

political pressures or random economic fluctuations.

Importantly, financial innovation could destabilize the

market’s

demand for

liquidity,

as

happened

with

changes

in

consumer

credit

pat- terns in

the 1970s. When this happens, a given K-Percent Rule that

previously delivered

stability

could

become

destabilizing.

In

addition,

monetary

policy

when

2025 Presidential

Transition Project

Friedman

proposed the K-Percent Rule was very different from monetary

policy

today.

Adopting

a

K-Percent

Rule would

require considering

what transitions

need to take place.

Inflation-Targeting Rules.

Inflation targeting is the current

de facto Federal Reserve

rule.32 Under

inflation targeting, the Federal Reserve chooses a target infla-

tion

rate—essentially the highest

it thinks

the public

will accept—and

then tries

to

engineer

the

money

supply

to

achieve

that

goal.

Chairman

Jerome

Powell

and

others

before

him

have

used

2

percent

as

their

target

inflation

rate, although

some

are

now

floating

3 percent

or

4

percent.33 The

result

can

be

boom-and-bust

cycles

of

inflation

and

recession

driven by

disruptive policy

manipulations

both

because the

Federal

Reserve is

liable to

political

pressure and

because making

economic predictions

is very

difficult if

not

impossible.

Inflation and Growth–Targeting Rules.

Inflation and growth targeting is a

popular

proposal

for reforming

the

Federal

Reserve.

Two

of

the

most

prominent

versions of

inflation and growth

targeting are a

Taylor Rule

and Nominal

GDP (NGDP)

Targeting. Both

offer similar

costs and

benefits.

Economists

generally believe that the economy’s long-term real growth trend

is

determined by

non-monetary factors.

The

Fed’s

job

is

to

minimize

fluctuations around

that

trend nominal

growth rate.

Speculative booms

and

destructive

busts

caused by swings in total spending should be avoided. NGDP targeting

stabilizes total nominal spending

directly. The Taylor

Rule does

so indirectly,

operating through the federal funds rate.

NGDP

targeting keeps

total nominal

spending growth

on

a

steady path.

If

the

demand for money (liquidity)

rises, the Fed meets it by increasing the money supply;

if the

demand for

money falls,

the Fed

responds by

reducing the

money supply.

This minimizes

the

effects

of

demand

shocks

on the

economy.

For

example, if the

long-run

growth

rate

of

the

U.S.

economy

is

3

percent

and

the

Fed

has

a

5

per-

cent

NGDP

growth

target,

it

expands

the

money

supply

enough

to

boost

nominal

income

by

5

percent

each

year,

which

translates

into

3

percent

real

growth

and

2 percent

inflation.

How much

money

must

be

created

each

year

depends

on

how fast

money demand

is growing.

The Taylor Rule

works

similarly. It

says the

Fed should

raise its

policy rate

when

inflation

and

real

output

growth

are

above

trend

and

lower

its

policy

rate

when inflation and real

output growth are below trend. Whereas NGDP targeting

focuses

directly

on

stable

demand

as

an

outcome,

the

Taylor

Rule

focuses

on

the Fed’s more

reliable policy levers.

The problem with

both rules

is the

knowledge

burden they

place on

central bankers. These rules state that the Fed should

neutralize demand shocks but

not

respond

to

supply

shocks,

which

means

that

it

should

“see

through”

demand shocks

by

tolerating

higher (or

lower)

inflation.

In

theory,

this

has

much

to

recom- mend

it. In

practice, it

can be

very difficult to distinguish

between

demand-side

Mandate

for Leadership:

The

Conservative

Promise

destabilization

and

supply-side destabilization

in

real

time. There

also are

political

considerations:

Fed

officials

may

not

be

willing

to

curb

unjustified economic

booms

and

all

too

willing to

suppress necessary

economic restructuring

following a

bust. Either

rule likely

outperforms a strict

inflation target and

greatly

outperforms the

Fed’s

current

pseudo-inflation

target.

While

NGDP

targeting

and

the

Taylor Rule

have

much

to

commend

them, they

might

be

harder

to

explain

and

justify

to the

public.

Inflation

targeting

has

an

intelligibility

advantage:

Voters

know

what

it

means

to

stabilize

the dollar’s

purchasing

power.

Capable

elected

officials

must persuade

the public that the advantages of NGDP

targeting and the

Taylor Rule,

especially

in

terms

of

supporting

labor markets,

outweigh the

disadvantages.

MINIMUM EFFECTIVE REFORMS

Because

Washington operates

on two-year election

cycles, any

monetary reform must

take account

of disruption

to financial

markets and

the economy

at large.

Free

banking

and commodity-backed

money

offer

economic

benefits

by

limiting government

manipulation, inflation,

and

recessionary

cycles

while

dramatically reducing

federal

deficits,

but

given

potential

disruption

to

the

financial

system,

a K-Percent

Rule may

be a

more feasible

option. The

other rules

discussed

(infla- tion

targeting, NGDP targeting,

and the

Taylor Rule)

are more

complicated

but also more

flexible. While

their economic

benefits are

significant, public opinion

expressed

through the

lawmaking

process

in

the

Constitution

should

ultimately

determine the monetary-institutional order in a free society.

The minimum

of

effective

reforms includes

the following:

•

Eliminate “full

employment” from the

Fed’s mandate,

requiring it

to focus on price stability alone.

•

Have elected officials compel the Fed to specify its target

range for inflation

and inform the public of a concrete intended growth path.

There

should be

no more

“flexible

average inflation

targeting,”

which amounts to ex

post

justification for

bad policy.

•

Focus any

regulatory activities on

maintaining bank capital

adequacy.

Elected

officials must

clamp down

on the

Fed’s

incorporation of environmental,

social,

and

governance

factors

into

its

mandate,

including

by amending its

financial stability mandate.

•

Curb the Fed’s excessive last-resort lending practices.

These practices

are

directly

responsible for

“too big

to fail”

and the

institutionalization

of moral hazard in our financial system.

2025 Presidential

Transition Project

•

Appoint a

commission to explore

the mission

of the

Federal

Reserve, alternatives

to the

Federal Reserve

system, and

the nation’s

financial

regulatory

apparatus.

•

Prevent the institution of a central bank digital currency

(CBDC).

A CBDC

would

provide

unprecedented

surveillance

and

potential

control

of financial

transactions without providing added benefits available through

existing

technologies.34

![]()

AUTHOR’S NOTE:

The preparation of this chapter was a collective enterprise of

individuals involved in the 2025

Presidential

Transition Project. All

contributors to this

chapter are

listed at

the front

of this

volume, but

Alexander

Salter,

Judy

Shelton,

and

Peter

St

Onge,

deserve

special

mention.

The

chapter

reflects

input

from

all

the

contributors, however, no

views expressed herein should be attributed to any specific

individual.

Mandate for

Leadership: The Conservative

Promise

ENDNOTES

1.

U.S.

Constitution,

Article

1,

Section

8,

https://www.law.cornell.edu/constitution

(accessed

January

23,

2023).

2.

For

example,

Alexander

Salter

and

Daniel

Smith

(2019)

show

that

Federal

Reserve

Chairs

become

more

favorable

toward monetary

discretion

once

they

are

confirmed

compared

to

previous

stances.

Alexander

William Salter and Daniel J.

Smith, “Political

Economists

or

Political

Economists? The Role of Political

Environments

in the

Formation of

Fed Policy Under

Burns,

Greenspan, and

Bernanke,”

Quarterly Review

of Economics and

Finance, Vol. 71 (February 2019), pp. 1–13.

3.

Sarah

Binder,

“The

Federal

Reserve

as

a

‘Political’

Institution,”

American

Academy

of

Arts

and

Sciences

Bulletin,

Vol.

LXIX,

No.

3

(Spring

2016),

pp.

47–49,

https://www.amacad.org/sites/default/files/bulletin/

downloads/bulletin_Spring2016.pdf

(accessed

January

23,

2023).

See

also

Charles

L.

Weise,

“Political

Pressures on Monetary Policy

During the US Great Inflation,”

American Economic

Journal:

Macroeconomics,

Vol.

4,

No.

2

(April

2012),

pp.

33–64,

https://www.haverford.edu/sites/default/files/Department/Economics/

Weise_Political_Pressures_on%20Monetary_Policy.pdf

(accessed

January

23,

2023).

4.

The

Federal

Reserve’s

financial

stability

mandate

is

poorly

defined.

The

Fed

has

taken

advantage

of

the

statutory

vagueness

and

proceeded

as

if

it

has

the

authority

to

engage

in

these

activities,

although

it

is

highly

questionable whether this is permissible.

5.

12

U.S.C.

§

225a,

https://www.law.cornell.edu/uscode/text/12/225a

(accessed

January

23,

2023).

6.

See Peter J.

Boettke, Alexander William Salter, and Daniel J. Smith,

Money

and the

Rule of

Law:

Generality and Predictability in

Monetary

Institutions

(Cambridge, UK: Cambridge University Press, 2021).

7.

George Selgin, William D. Lastrapes,

and Lawrence H. White, “Has

the Fed Been a Failure?”

Journal

of

Macroeconomics, Vol. 34, No. 3 (September 2012), pp.

569–596,

https://www.sciencedirect.com/science/

article/abs/pii/S0164070412000304

(accessed

January

24,

2023).

8.

This includes

federal programs that automatically provide for adjustments as

the economy contracts (for example, unemployment

insurance or the Supplemental Nutrition Assistance Program).

9.

Mark

Segal,

“Fed

to

Launch

Climate

Risk

Resilience

Tests

with

Big

Banks,”

ESG

Today,

September

30,

2022,

https://www.esgtoday.com/fed-to-launch-climate-risk-resilience-tests-with-big-banks/

(accessed

January

23,

2023).

10.

Kenneth J. Robinson, “Savings and Loan Crisis 1980–1989,”

Federal Reserve Bank of St. Louis, Federal Reserve

History, November 22, 2013,

https://www.federalreservehistory.org/essays/savings-and-loan-crisis

(accessed

January

23,

2023).

11.

Russell Roberts, “Gambling with

Other

People’s Money: How Perverted

Incentives Caused the Financial Crisis,”

Mercatus

Center

at

George

Mason

University,

May

2010,

https://www.mercatus.org/system/files/RUSS-final.

pdf

(accessed January 24, 2023).

12.

Board of Governors of

the

Federal Reserve System,

Credit and Liquidity Programs Balance Sheet Data

Series, 2007–2022,

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

(accessed January 24, 2023).

13.

Board of Governors of the Federal Reserve System, U.S.

Treasury Securities Data Series (TREAST), 2004–2022,

https://fred.stlouisfed.org/series/TREAST

(accessed January 24, 2023).

14.

Board of Governors of the Federal Reserve System,

Mortgage-Backed Securities Data Series (WSHOMCB), 2004–2022,

https://fred.stlouisfed.org/series/WSHOMCB

(accessed

January

24,

2023).

15.

Board of Governors of the

Federal Reserve System, Total

Assets (Less Eliminations from Consolidation) Data

Series

(WALCL),

2004–2022,

https://fred.stlouisfed.org/series/WALCL

(accessed

January

24,

2023).

16.

Federal Reserve

Bank of

St. Louis,

“S&P Dow

Jones Indices

LLC,

S&P/Case–Shiller U.S.

National Home

Price Index (CSUSHPINSA),”

https://fred.stlouisfed.org/series/CSUSHPINSA

(accessed

January

24,

2023).

The

Case–Shiller

Home

Price

Index

tracks

home

prices

given

a

constant

level

of

quality.

See

S&P

Dow

Jones

Indices,

“Real

Estate:

S&P CoreLogic Case–Shiller

Home Price Indices,”

https://www.spglobal.com/spdji/en/index-family/indicators/sp-

corelogic-case-shiller/sp-corelogic-case-shiller-composite/#overview

(accessed January 24, 2023).

17.

Federal Reserve Bank of St.

Louis, “Real Residential

Property Prices for United States (QUSR628BIS),”

https://

fred.stlouisfed.org/series/QUSR368BIS

(accessed

January

24,

2023).

18.

Longterm Trends, “Home Price

to

Income Ratio (US & UK): Home

Price to Median Household Income

Ratio (US),”

https://www.longtermtrends.net/home-price-median-annual-income-ratio/

(accessed January 24, 2023).

2025 Presidential

Transition Project

19.

Federal Reserve Bank of Atlanta, “Metro Area Home

Ownership Affordability Monitor (HOAM) Index,” October 2022,

https://www.atlantafed.org/center-for-housing-and-policy/data-and-tools/home-ownership-

affordability-monitor.aspx

(accessed January

24, 2023).

20.

Apartment List Research Team, “Apartment List National

Rent Report,” January 4, 2023,

https://www.

apartmentlist.com/research/national-rent-data

(accessed January 24,

2023).

21.

Primary drivers of rising real estate prices nationally

also include government subsidies and government guarantees through

government-sponsored enterprises (GSEs)—namely, Fannie Mae and

Freddie Mac. “The

unpriced

implicit

guarantee,

which

reduced

interest

rates

for

mortgage

borrowers,

helped

cause

more

of

the

economy’s capital to be

invested in housing than might otherwise have been the case.”

Congressional Budget

Office,

“Transitioning to

Alternative

Structures

for

Housing

Finance:

An

Update,”

August

2018,

p.

7,

https://

www.cbo.gov/system/files/2018-08/54218-GSEupdate.pdf

(accessed

January

24,

2023).

22.

Board

of

Governors

of

the

Federal

Reserve

System,

Reserves

of

Depository

Institutions

Data

Series (TOTRESNS), 1960–2022,

https://fred.stlouisfed.org/series/TOTRESNS (accessed

January 24, 2023).

23.

George

A.

Selgin,

The

Theory of

Free Banking:

Money Supply

Under

Competitive Note

Issue

(Totowa, NJ:

Rowman & Littlefield, 1998).

See also Alexander William Salter and Andrew T. Young, “A Theory

of Self- Enforcing

Monetary

Constitutions with Reference

to the

Suffolk

System, 1825–1858,”

Journal of

Economic

Behavior & Organization, Vol. 156

(December 2018), pp 13–22.

24.

Reforms

should

also

strengthen

the

incentives

of

bank

depositors

(customers)

and

bank

shareholders

(owners) to monitor bank

portfolios. Deposit insurance undermines the former, as even

President Franklin Roosevelt

recognized. Bailouts and

last-resort lending undermine

the latter.

25.

Under the

current system, banks are supplying the U.S. dollars.

Legislation would been needed that includes a mechanism

for supplying

the correct

number of

U.S. dollars

along with

their own

notes.

26.

F.

A.

Hayek,

Denationalization of Money: An Analysis of the Theory and

Current Practice of Concurrent

Currencies

(London, UK: Institute of Economic Affairs, 1976).

27.

Kate

Davidson, “GOP Platform

Includes

Proposal to

Study Return

to Gold

Standard,”

The

Wall Street

Journal, July 20, 2016,

https://www.wsj.com/articles/gop-platform-includes-proposal-to-study-return-to-gold-

standard-1469047214?mod=article_inline

(accessed

January

24,

2023).

28.

H.R.

9157,

To

Define

the

Dollar

as

a

Fixed

Weight

of

Gold,

and

for

Other

Purposes

(Gold Standard

Restoration

Act), 117th Congress,

introduced October 7, 2022,

https://www.congress.gov/117/bills/hr9157/BILLS-117hr9157ih.

pdf (accessed

January 24, 2023).

29.

Judy Shelton, “Gold and

Government,”

Cato

Journal, Vol.

32, No. 2 (Spring/Summer 2012), pp. 333–347,

https://www.cato.org/sites/cato.org/files/serials/files/cato-journal/2012/7/v32n2-9.pdf?mod=article_inline (accessed January 24, 2023).

30.

Lawrence

H.

White,

“Making

the

Transition

to

a

New

Gold

Standard,”

Cato

Journal,

Vol.

32,

No.

2

(Spring/

Summer 2012), pp. 411–421,

https://www.cato.org/sites/cato.org/files/serials/files/cato-journal/2012/7/v32n2-

14.pdf

(accessed

January

24,

2023).

31.

Juha

Kilponen

and

Kai

Leitemo,

“Model

Uncertainty

and

Delegation:

A

Case

for

Friedman’s

k-Percent

Money

Growth

Rule?”

Journal

of Money,

Credit and

Banking,

Vol. 40,

No. 2/3

(March–April 2008), pp.

547–556.

32.

Adam Shapiro and Daniel J. Wilson, “The Evolution of the

FOMC’s Explicit Inflation Target,” Federal Reserve

Bank

of San

Francisco,

FRBSF

Economic Letter

No.

2019–12, April

15, 2019,

https://www.frbsf.org/wp-content/

uploads/sites/4/el2019-12.pdf

(accessed January 24, 2023).

33.

WSJ Pro,

“Research Says

a 3% Fed

Inflation Target Could

Boost Job

Market,”

The

Wall Street

Journal, August

18, 2021,

https://www.wsj.com/articles/research-says-a-3-fed-inflation-target-could-boost-job-market-

11629308829#:~:text=Research%20Says%20a%203%25%20Fed%20Inflation%20Target%20Could%2-

0Boost%20Job%20Market,-Aug.&text=Two%20former%20high%2Dlevel%20Federal,help%20bolster%20

the%20job%20market

(accessed

January

24,

2023).

See

also

Oliver

Blanchard,

“It

Is

Time

to

Revisit

the

2% Inflation Target,”

Financial

Times,

November 28, 2022,

https://www.ft.com/content/02c8a9ac-b71d-4cef-a6ff-

cac120d25588

(accessed

January

24,

2023).

34.

Alexander

William

Salter,

“CBDC

in

the

USA:

Not

Now,

Not

Ever,”

American

Institute

for

Economic

Research, December, 13, 2022,

https://www.aier.org/article/cbdc-in-the-usa-not-now-not-ever/

(accessed

February 1,

2022).

25

SMALL

BUSINESS

ADMINISTRATION

Karen

Kerrigan

MISSION

STATEMENT

The

U.S. Small

Business Administration

(SBA) supports

U.S.

entrepreneurship and

small

business

growth by

strengthening

free

enterprise through

policy advo-

cacy

and

facilitating programs

that help

entrepreneurs

to

launch and

grow their

businesses

and compete

effectively in

the global

marketplace.

OVERVIEW

Created almost

70 years ago, the SBA was launched under the Small Business

Act

with a

mission to

“aid, counsel,

assist and

protect,

insofar as

is possible,

the interests

of

small

business

concerns.”1 According

to

its

current mission

statement:

The

U.S. Small

Business

Administration

(SBA)

helps

Americans

start,

grow,

and build resilient businesses.

SBA

was

created

in

1953

as

an

independent

agency of

the

federal

government

to aid,

counsel,

assist and

protect the

interests of

small business

concerns; preserve

free

competitive

enterprise;

and

maintain

and

strengthen

the

overall economy

of our nation.2

The SBA’s founding mission has

evolved over time as programs have been

expanded or implemented,

subject to the philosophical grounding of each Admin-

istration as

well as

assorted

economic challenges

and the

occurrence of

natural disasters.

Because of

its distinct

role in

the federal

government, the SBA

became

Mandate for

Leadership: The Conservative

Promise

the

default agency

for

providing

disaster loans

to

small

businesses, homeowners,

renters,

and

organizations.

As

a

result, hundreds

of

billions

of

taxpayer

dollars have

been

funneled

through the

agency to

businesses and

individuals over

the

years.

Some

SBA

programs

are

effective;

others are

not. The

largest program

in

SBA’s

history,

the Paycheck

Protection

Program (PPP),

has been

credited with

saving millions of

jobs during the COVID-19 pandemic.3 A conservative Administration

would rightly

focus on

saving small

businesses during

such a

crisis. At

the

same

time,

however,

various SBA

programs have

generated waste,

fraud, and

misman- agement of

taxpayer dollars.

For

example, and

more recently,

more than

$1

trillion

in

COVID-19

relief was

distributed

through the

SBA.4 The SBA’s EIDL

(Economic Injury Disaster

Loan) Advance program in particular shows the dangers

that can come with direct government lending. EIDL Advance

provided direct cash grants and loans to

small businesses. The SBA

Office of Inspector General “identified $78.1 billion in

potentially fraudulent

EIDL

loans

and

grants

paid

to

ineligible

entities,”5 which represented

more than half of all funds spent through the program. Although

PPP

worked

through

private

lenders and

as

a

result experienced

relatively less

fraud than EIDL

experienced, it is estimated “that at least 70,000 [PPP] loans

were potentially

fraudulent.”6

ORIGIN,

HISTORY, AND

CORE

FUNCTIONS

In 1954, the agency began to execute

such core functions as “making and guaranteeing

loans for

small

businesses,” “ensuring

that small

businesses earn a ‘fair

proportion’ of government

contracts and

sales of

surplus

property,” and “provid[ing]

business

owners

with

management

and

business

training.”7

In 1970,

President Richard Nixon’s Executive Order 11518 enhanced the

agen-

cy’s

advocacy

role by

providing for

the

“increased

representation

of

the

interests of

small business

concerns before

departments and

agencies of

the

United

States

Government.”8 This

advocacy

role was

strengthened with

the

adoption

of

the

Small Business

Amendments

of

1974,9 which

established

the

Chief

Counsel for

Advocacy, and

was then

reinforced and expanded

in 1976

with the

creation of

the Office of

Advocacy,

providing

additional

resources

to

ensure

that

small

businesses

had

a voice in the

regulatory process.

In

1980, the

Regulatory Flexibility

Act

(RFA)10 further

strengthened

the

Office

of

Advocacy’s role, providing accountability across federal

agencies to ensure that they

considered the

impact of

their

rulemakings on small

businesses. The RFA requires

federal agencies “to consider the effects of their regulations

on small businesses

and other

small

entities,”11 and

the

Office

of

Advocacy

is

charged

with

ensuring that federal agencies abide by the law and is required to provide

an annual

report to the

President and the Senate and House Committees on Small Business.12 In

addition,

the

Trade

Facilitation and

Trade Enforcement

Act

(TFTEA)

of

201613

2025 Presidential

Transition Project

established

a

new

role for

the

Office

of

Advocacy:

“to

facilitate

greater consider-

ation

of

small business

economic issues

during international

trade negotiations.”14 This

small

office

has

been

relatively effective

over the

years—and more

produc-

tive

during

periods

when

a

strong Chief

Counsel for

Advocacy has

been installed

to

utilize the

Office of

Advocacy’s

authority aggressively

to provide

a check on regulatory

overreach. The

office is

one of

the bright

spots within

the SBA

that a

conservative Administration

could

supercharge

to

dismantle

extreme

regulatory

policies

and

advance

limited-government

reforms

that

promote

economic

freedom

and

opportunity.

Currently,

the

SBA’s

four core

functions include:

•

Access to capital.

SBA maintains assorted financing and lending

programs

for small

businesses,

from

microlending

to

debt

and

equity

investment capital.

•

Entrepreneurial development programs.

SBA provides “free” or low-

cost

training

at more

than

1,800

locations

and

through

online

platforms and

webinars.

•

Government contracting support programs.

Through goals

established by the SBA

for federal

departments and agencies,

the broader

goal is

to ensure that

small

businesses win 23

percent of

prime

contracts.

•

Advocacy.

This

independent office within

the SBA

works to

ensure that

federal

agencies

consider

small

businesses’

concerns

and

impact

in rulemakings.

The office

also conducts

small-business research.

BUDGETARY

FLUCTUATION

SBA’s

budget and

programs have

expanded significantly

under some

Admin-

istrations

and

have

been scaled

back under

others. President

Ronald Reagan

cut

the SBA’s budget by more than 30 percent, and his annual budgets

regularly pro- posed

to

eliminate

the

agency

altogether.15 Under

President

George W.

Bush, SBA

Administrator

Hector Barreto

said that

SBA’s goal

was “to

do more

with less,”16

but

this changed

because of

Hurricane

Katrina and

a surge

in disaster

funding. In 2016, President

Barack Obama

considered streamlining and

combining SBA

programs

and

other

business-related

agencies

and

programs

under

one

entity

at

the U.S. Department of

Commerce, but opposition within the small-business lobby

in Washington scuttled the effort.17

In

general, SBA

budget fluctuations

have been

driven by

several factors

such as efforts

by

Administrations

either to

cut

or

to

greatly

expand programs,

the

need

to

boost

disaster assistance

because of

economic or

weather-related

events,

business

Mandate for

Leadership: The Conservative

Promise

loan credit

subsidy costs, and miscellaneous program “enhancements” to

support

small

businesses

through economic

challenges or

circumstances.

As

noted by

the Congressional

Research Service:

Overall,

the

SBA’s appropriations

have

ranged

from

a

high

of

over

$761.9

billion in

FY2020 to

a low

of $571.8

million in

FY2007. Much

of this

volatility is

due to significant

variation in supplemental

appropriations for disaster

assistance

to address

economic

damages

caused

by

major

hurricanes

and

for SBA

lending program

enhancements to

help small

businesses

access capital during

and immediately following

recessions. For example,

in FY2020,

the SBA

received over

$760.9 billion

in supplemental

appropriations to assist small

businesses adversely affected

by the

novel

coronavirus (COVID-

19)

pandemic.18

The

CRS

further

notes

that

“[o]verall,

since

FY2000,

appropriations

for

SBA’s

other programs, excluding

supplemental appropriations,

have increased at a

pace that exceeds inflation.”19

In

terms of

current loan

volume, the

SBA

“reached

nearly $43

billion in

fund- ing to

small businesses,

providing more

than 62,000

traditional loans

through its

7(a),

504, and

Microloan

lending partners

and over

1,200

investments through SBA

licensed

Small

Business

Investment

Companies

(SBICs)

for

Fiscal

Year

(FY) 2022.”20 The agency’s total budgetary

resources for FY 2022 amount to $44.25 billion, which represents

0.4 percent

of the

FY 2022

U.S. federal

budget.21

HISTORY

OF

MISMANAGEMENT

Throughout

its

history,

various SBA

programs and

practices have

generated

negative news headlines and scathing Government Accountability Office

(GAO)

and

Inspector General

(IG) reports

that have

centered on

mismanagement,

lack of

competent personnel

and/or systems,

and

waste,

fraud and

abuse.22 From

the

8a

program23 to

Hurricane

Katrina24 to

the

more current

COVID-19 (EIDL)

program

and

PPP

lending

program,25 the

SBA

has

managed

to

maintain

its

lending

role even

when

repeated system

failures have

affected its

distribution of

funds.

Congress has been somewhat

responsive, pressuring the SBA to clean up

fraud-related

matters

within

its

COVID-19

lending

and

grant

programs.26 Repub- licans

in

the

U.S. House

of

Representatives

have gone

farther, specifying

that the

SBA needs to

improve transparency and accountability and deal with mission

creep,